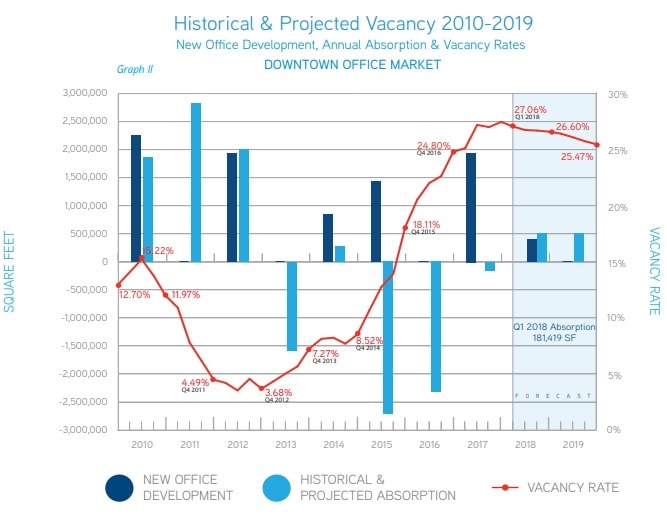

Calgary entered the 2018 commercial market with a cautious optimism. This is a relief from a two-year recession where vacancy rates increased from 8.52% at the beginning of 2015 to 27.06% by mid 2018.

West Texas Intermediate (WTI) has been trading between $60-70 a barrel since late December. However, Western Canadian Select (WCS) has been trading at a discount to WTI and exporting Alberta oil is proving difficult as pipeline approvals are delayed. This has slowed the growth potential for Calgary’s energy based economy

We are predicting that the bottom of the commercial market will be in sometime this year. With that being said the market has experienced a flight to quality space. Top quality pockets of 5,000 sq. ft. or less are being quickly leased in the current market.

What does this mean to the office user? If you intend to take advantage of the renter’s commercial market right now, this next 12-18 months may be the most opportune time to look for savings in your rental expense or that chance to upgrade to A quality space at rents tenant’s paid for C space in 2014 at 6% vacancy. The window is wide open now but maybe closing soon.

Source: Avison Young Q1 2018 Market Report

Interested in seeing what’s out there? Contact us today and we’ll help you find the perfect deal for your business.